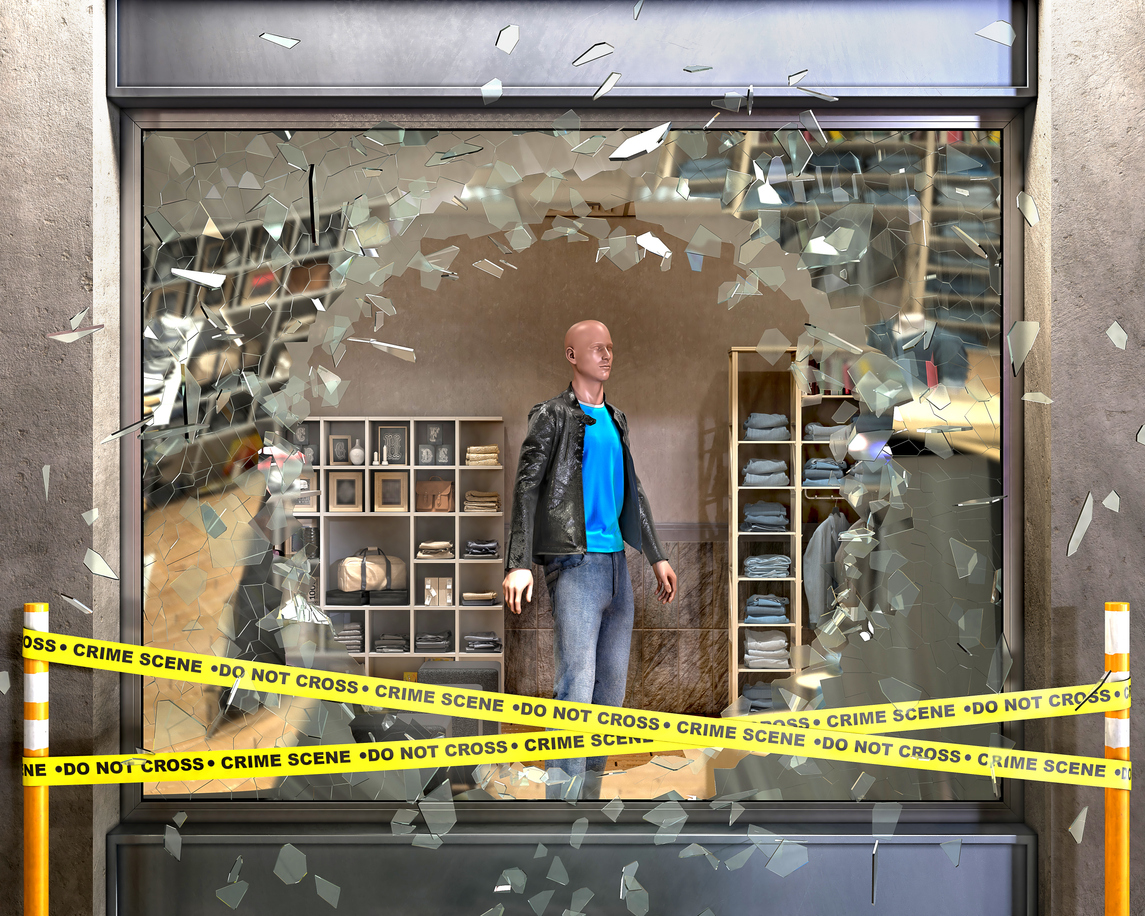

Knowing what to do in the event of a smash and grab on your store can help you save some capital and reduce some loss. Your company’s inventory is valuable and represents a significant investment for your business. That financial loss is one of the reasons why a smash and grab can be so damaging to your operation. There are things that you can do both to prepare for such an occurrence and to help prevent it. Get the right crime and fidelity insurance for your business, and then take proactive mitigation steps.

How To Get Insurance That Covers a Smash and Grab

The first thing you should do to protect your business in case of a smash and grab loss is to secure the right insurance coverage. That means talking with a commercial insurance agent about crime and fidelity coverage. It provides you with the financial protection that you need in the event of a robbery. When you invest in smash and grab coverage, you’ll have to decide how much protection you want, which determines your policy’s payout limits. Consider your inventory value and the maximum potential loss from a smash and grab as you make this choice.

How To Protect Your Business From a Smash and Grab

The best way to reduce your risk of loss from a smash and grab is by proactively protecting your business. Install surveillance cameras and make them highly visible as a deterrent. If your business is in a high-crime area, consider hiring on-site security.

How To Handle a Smash and Grab Event

If surveillance and security deterrents aren’t enough to discourage a smash and grab, your staff should be prepared to respond appropriately. Train your staff members on safe robbery response, including:

- Don’t fight back. Give the robber what they are asking for and protect yourself.

- Try to remember as many features or distinctive marks as possible for identification.

- make a note of the type of weapon if possible so that you can specify it for law enforcement.

- Call the police immediately after the incident.

- Contact your crime and fidelity insurance agent to start the claim process.

- Create a thorough, detailed inventory of the stolen items.

These are the most important steps to ensure your staff’s safety and address the robbery’s aftermath. You should also ensure that any customers inside your business during the robbery are unhurt and transported to a safe location.

Smash and grab robberies are more common than you think, and you must protect your business, staff, and customers. These tips are an excellent start, along with the right crime and fidelity insurance policy. When you have the right coverage for a smash and grab loss, you can ease the financial burden on your business in the wake of the robbery.

About Haughn & Associates

Founded by Michael Haughn in 1986, Haughn & Associates is a full-service, family-owned, independent insurance agency based out of Dublin, Ohio. H&A strives to provide the best possible price and unique insurance solutions across a myriad of industries, including construction, IT, Habitation & Commercial Property, Agriculture, and Engineering. Devoted to providing the best of business insurance, life and disability insurance, personal insurance, employee benefits, and bonds, H&A is proof that success lies in long-standing client relations and satisfaction. To learn more about how H&A can be of service to you, contact us at (877) 802-2278.